Boeing Co earned a profit for the first time in nearly two years, surprising Wall Street and hinting at a potential turnaround after one of the worst financial crises in the planemaker’s century-long history. The shares jumped.

The adjusted profit of 40 cents a share wasn’t the only sign of progress in the company’s second-quarter earnings report, released Wednesday. The manufacturer burned through just $705mn during the period, better than the $2.76bn outflow that analysts had predicted.

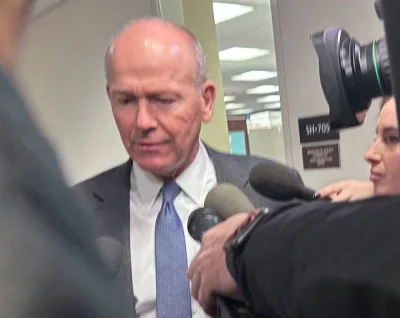

The results suggest that Boeing is starting to emerge from a deep slump caused by the Covid-19 outbreak and the company’s own quality lapses, which were tied to two deadly crashes of its best-selling 737 Max plane. With its business stabilising, Boeing has halted large-scale job cuts well short of earlier plans to eliminate nearly 20% of its workforce, said chief executive officer Dave Calhoun.

“You will see our efforts gaining traction and our recovery accelerating, as reflected in improved revenue, earnings and cash flow, as well as stabilising workforce levels,” Calhoun told employees in a message that was released with quarterly results. Boeing now plans to hold employment steady at 140,000 jobs, representing a 13% reduction from pre-Covid levels.

Boeing advanced 3.9% to $231 before the start of regular trading in New York. The shares rose 3.8% this year through Tuesday, trailing the 15% gain for the Dow Jones Industrial Average.

The surprise second-quarter profit compared to an expected loss of 81 cents, which was the average of estimates compiled by Bloomberg. Revenue rose 44% to $17bn. Analysts had predicted $16.5bn.

Still, the Chicago-based company faces a long road to recovery, and a powerful rival in Airbus SE, which is looking to capitalise on its larger order backlog. Airbus, based in Toulouse, France, is slated to report its results on Thursday.

Another obstacle for Boeing is frayed US-China relations, which have injected uncertainty into the company’s timetable for speeding production of the Max, which is meant to be a cash cow.

The Boeing 737 Max 10 airplane prepares to take off in Seattle. Boeing earned a profit for the first time in nearly two years, surprising Wall Street and hinting at a potential turnaround after one of the worst financial crises in its history.