Hedge funds resumed heavy buying of crude oil and petroleum products last week, with the previous week’s bout of profit-taking halted by increasing optimism over the global economy and hopes for more output cuts by Saudi Arabia.

Futures and options equivalent to 144mn barrels in the six major petroleum contracts were purchased by hedge funds and other money managers in the week to November 26, the most in a single week for more than two years.

Portfolio managers have added to their positions in six of the past seven weeks, by a total of 291mn barrels, according to records published by ICE Futures Europe and the US Commodity Futures Trading Commission.

Last week’s buying was concentrated in crude, with big purchases in NYMEX and ICE WTI, amounting to 67mn barrels, plus 38mn barrels of ICE Brent. Funds bought the most crude for almost three years after the December 2016 production pact agreed by Opec and non-Opec countries.

But the latest week featured purchases across the board, including US gasoline (14mn barrels), US diesel (7mn) and European gasoil (17mn). In a sign of increasing bullishness, most of the NYMEX WTI short positions initiated in late September and early October had been closed out.

WTI short positions had been cut back to only 40mn barrels, the same as on September 17, down from a peak of 126mn on October 22.

Fund buying is being driven by a combination of increasing optimism over the global economy and slower growth in US oil production.

Fund managers may also have bought in the expectation that Saudi Arabia and its allies in the expanded Opec+ group of exporters will agree to extend or deepen their output cuts when they meet this week.

Recent data suggests that the global economy may have narrowly averted a recession at the end of the third quarter, with signs of stabilising or slightly improving business activity going into the final three months of the year.

Industrial production numbers from the United States, Germany and Japan indicate the downturn bottoming out in August and September.

At the same time, US oil production is still climbing, reaching a record 12.5mn barrels per day (bpd) in September, but the rate of growth has moderated in response to price declines over the past 12 months.

Prospects for continued output restraint coupled with healthier consumption growth have encouraged hedge funds to boost their overall bullish position in crude and fuels to 728mn barrels, up from 437mn in early October.

But with so much bullishness built into prices, the balance of risks is shifting gradually, at least from a positioning perspective.

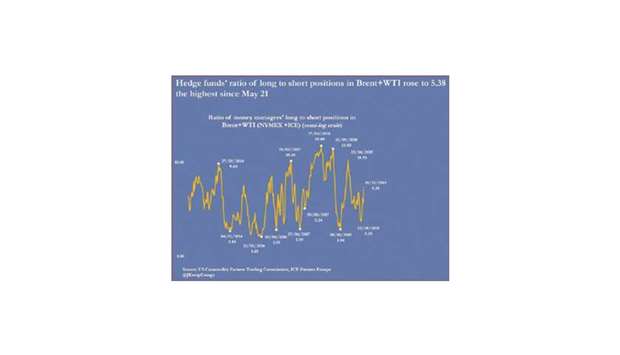

Fund managers hold almost five bullish long futures and options positions in petroleum for every bearish short one.

That long-short ratio has almost doubled since the middle of October to stand at its highest since late May.

The balance of risks is now close to neutral.

But that marks a significant change from mid-October, when it was concentrated on the upside.

n John Kemp is a Reuters market analyst. The views expressed are his own.

.