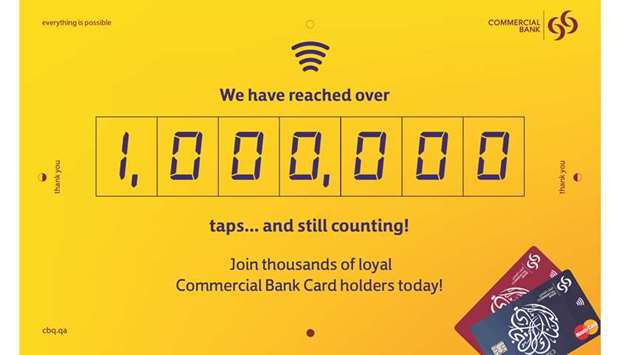

Since the launching of its new contactless technology a year ago, Commercial Bank has successfully reached over 1mn taps from customers using their contactless cards at their favourite local and international outlets.

The contactless feature was well-received by the bank’s customers and it took approximately six months for the bank to announce a milestone of 100,000 taps in August 2018.

Tap N’ Pay, a contactless payment service provided by Commercial Bank, is a much simpler, faster, and convenient method of payment by merely tapping debit or credit card against the reader in order to complete payments and transactions. What makes this feature even more exceptional is that it does not require the card PIN for purchases worth less than QR100.

Nevertheless, a PIN code is required whenever the amount exceeds QR100. Not only is it simple, fast, and convenient, but Tap N’ Pay is also a safe payment method thanks to the multiple security layers the contactless cards are equipped with.

“Contactless is the future of card payment. Day by day, we are witnessing an increased number of customers adopting this new, simple, and fast technology, while steering away from cash to contactless debit and credit cards. “We are delighted to see how interested customers are in this technology, and excited about watching this number

increase further this year.

This achievement would not have been possible without the trust of our loyal customers. The future awaits and we are surely on the right path,” said Commercial Bank’s AGM and head of Cards & Payments Roya Khajeh.